These are extremely bullish times in the crypto market — at least for Bitcoin. The leading digital currency has once again reached an all-time high today, surpassing $116,000. The bulls are unstoppable, and this is now gradually bringing most altcoins back to life. First and foremost: Ethereum. By far the largest altcoin by market capitalization is making a run for the $3,000 mark, thanks in no small part to BlackRock, the world’s largest asset manager.

The most important facts at a glance:

Bitcoin has reached a new all-time high of over $116,000.

However, it appears that institutional interest is gradually shifting toward Ethereum.

Yesterday, BlackRock invested $125 million in Bitcoin, while $158 million was allocated to Ethereum.

BlackRock is buying Bitcoin and Ethereum to cover its crypto ETFs. Demand for the Ethereum ETF was higher yesterday.

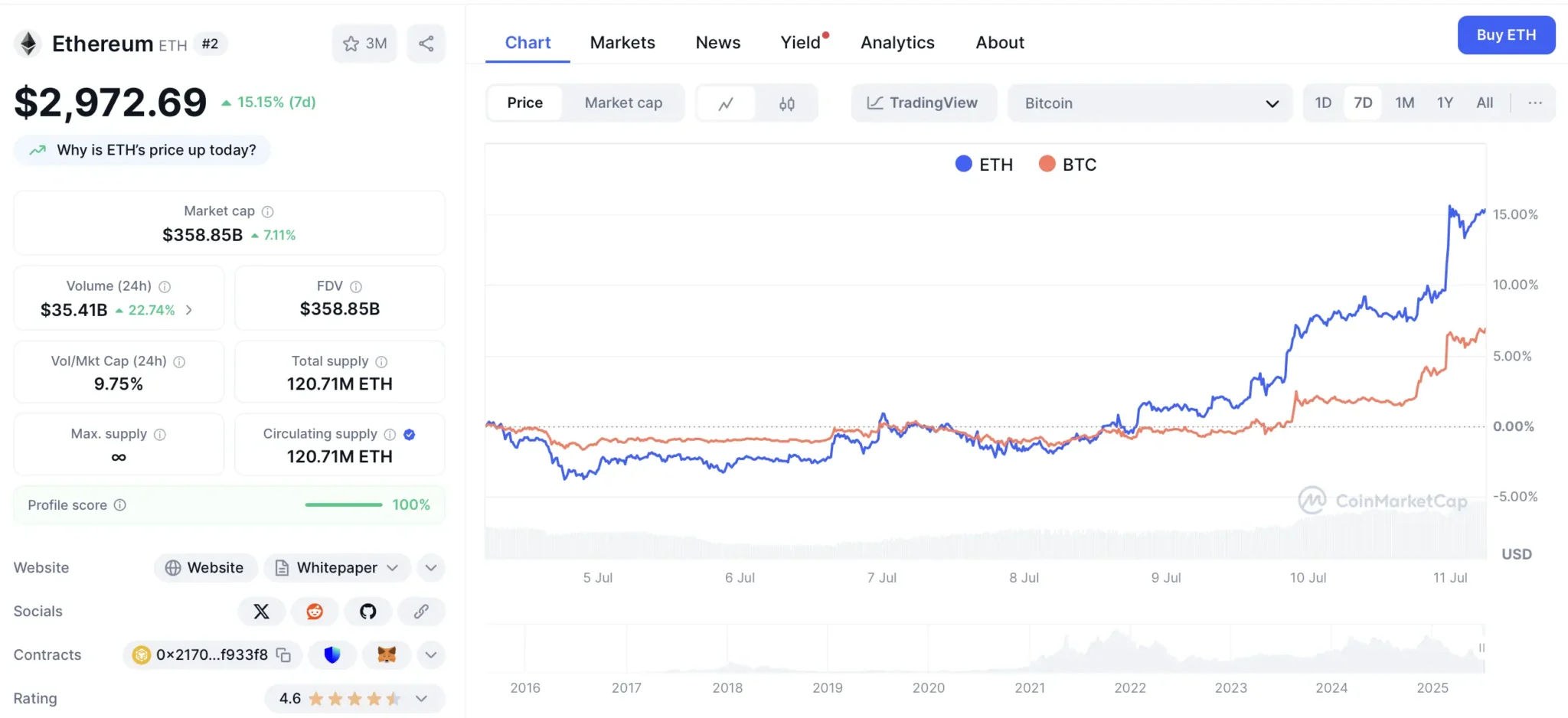

Ethereum has gained over 15% in the last week, while Bitcoin has risen by nearly 7%.

BlackRock bets on Ethereum

Crypto ETFs may have been the best thing to happen to the market in terms of price development. Since their launch, it has become much easier for institutional investors to enter the crypto space, and confidence in cryptocurrencies has increased. No longer just “internet money” used by criminals — crypto is becoming a solid part of Wall Street.

While initially only the spot Bitcoin ETFs were a massive success, attracting billions of dollars in capital inflows within a short time, Ethereum funds are now gaining traction as well. BlackRock is the world’s largest asset manager and one of the issuers of these funds. That means the company buys Bitcoin and Ethereum when investors put money into the respective ETFs. And now, an extraordinary pattern is emerging.

Yesterday, BlackRock spent $158 million to buy Ethereum. At the same time, “only” $125 million was used to buy Bitcoin. This clearly shows that the financial giant’s clients are now acquiring a taste for Ethereum as well. This is also reflected in the price.

Ethereum is catching up

Investors had almost given up hope that Ethereum would regain momentum. After all, Bitcoin already surpassed its 2021 highs last year, while Ethereum was still trading below $3,000. Ethereum’s all-time high from 2021 is $4,891. The two top coins had continued to drift further apart.

But now, a different picture has emerged in recent weeks. After Bitcoin dominance kept rising and Ethereum was unable to keep up, a shift in power is taking place. Although Bitcoin rose by nearly 7% over the past week, Ethereum clearly outperformed.

(Bitcoin and Ethereum performance in the last week compared – Source: Coinmarketcap)

The world’s second-largest cryptocurrency has gained over 15% in the same period. A picture that may repeat itself more frequently in the near future. The current Ethereum rally is still largely driven by institutional investors, as evidenced by the capital inflows into the spot ETFs.

But more and more companies are now also turning to direct Ethereum purchases. In addition to Sharplink Gaming and Bitmine, there are now almost daily reports of companies building Ethereum treasuries to put their $ETH to work and earn a yield through staking, beyond price appreciation.

Even though Ethereum has seen a steep rise in recent weeks, there is still plenty of upside potential. A new all-time high well above $5,000 now seems almost inevitable under current conditions. In the short term, such increases can of course be followed by minor corrections, but the long-term outlook for Ethereum is extremely bullish — with some experts expecting a price of $10,000.