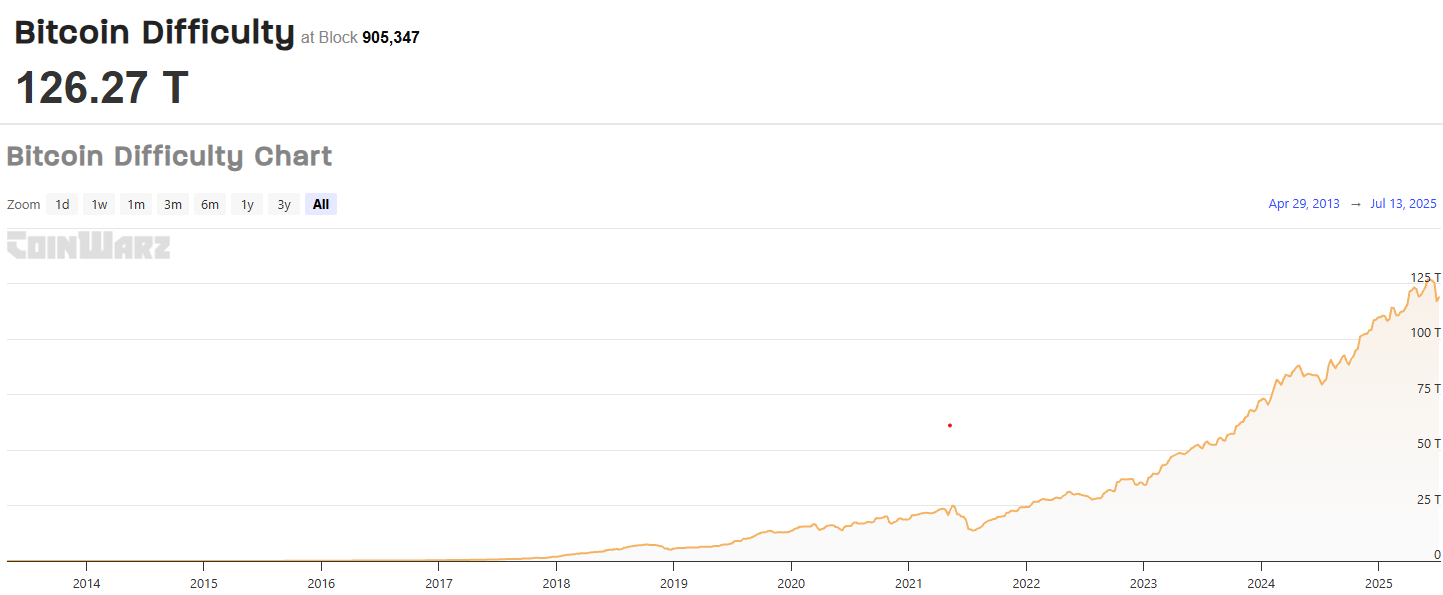

The Bitcoin network has once again raised the bar for miners. On July 13, 2025, at block height 905,346, the mining difficulty adjusted upward by 7.96%, reaching a new all-time high of 126.27 trillion (T). This marks one of the most significant difficulty increases in recent months, reflecting the continued growth in computational power securing the Bitcoin network.

According to data from CoinWarz, the average hashrate over the last seven days reached 910.14 exahashes per second (EH/s). This surge in network activity is likely driven by increased participation from industrial-scale mining farms and the deployment of more efficient ASIC hardware, particularly in North America and parts of Asia.

What Is Mining Difficulty – and Why It Matters

Mining difficulty is an automatic adjustment within Bitcoin's protocol designed to keep block production consistent at approximately one block every 10 minutes. As more computing power (hashrate) enters the network, the difficulty increases to maintain this balance.

This latest jump means that miners now need significantly more computational effort to solve blocks. For smaller or less energy-efficient operations, this could mean lower profitability—or even forced shutdowns if operational costs exceed revenue.

A Competitive Mining Environment

The new record difficulty of 126.27 T suggests that the competition among miners is intensifying. With Bitcoin’s price still hovering above $110,000, mining remains highly lucrative, but only for those with access to low-cost power and top-tier hardware.

As the next difficulty adjustment approaches in roughly two weeks, analysts will watch closely to see if the network’s momentum continues—or if some miners drop off due to rising operational pressures.

Summary of Key Stats (as of Block 905,346):

New Difficulty: 126.27 T

Difficulty Change: +7.96%

Average Hashrate (7-day): 910.14 EH/s

Previous Difficulty: ~116.98 T